does square cash app report to irs

Cash App for Business accounts that accept over 20000 and more than 200 payments per calendar year cumulatively with Square will receive a Form 1099-K. So what does Cash App report to the IRS.

Solved Your First Tax Season With Square The Seller Community

You processed more than 20000 in gross sales from goods or services in the.

. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. All credit card processing companies including Square are required by the IRS to report the earnings of those merchants who process over 20000 and over 200 credit card payments cash excluded per calendar year before January 31. Yes you can use cash app for the tax refund deposit.

If you deposit in a bank more than 10000 cash meaning actual bills or cashiers checks at a time the bank must report this to the IRS. One of the first things to figure out is whether or not you qualify to receive a 1099-K form. Square does not currently report to the IRS on behalf of their sellers.

By Tim Fitzsimons. A business transaction is defined as payment. E-filing is free quick and secure.

And there is no longer a transaction minimum down from 200. In the US the state where your taxpayer information is associated will determine your qualification for. In accordance with thier User Agreement Section 24 they will annually.

Filers will receive an electronic acknowledgement of each form they file. And the IRS website says. And while recent apps like Venmo Square and Cashapp.

Elise AmendolaAP In this June 15 2018 file photo twenty. Rather small business owners independent contractors and those with a. But if you choose to receive payment via a credit or debit card you must report that income on a specific tax.

As long as your account is under your real name and correct address. The IRS requires Square to report every account that meets the Form 1099-K requirementsincluding non-profits. The qualifications for these forms vary based on the state.

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. Answer 1 of 3. This applies to businesses and any other individuals making sales of 600 or more through a P2P.

It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App. They are also required to file a corresponding tax form with the IRS. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service.

Cash App does not provide tax advice. If you withdraw more than 10000 in cash or cashiers checks the bank must also report this. Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps.

Starting January 1 2022 the American Rescue Plan Act of 2021 requires services like Cash App to report payments for goods and services on Form 1099-K when those transactions total 600. The IRS wants to crack down on businesses that use cash apps as a way to circumvent banks and traditional forms of reporting income. An FAQ from the IRS is available here.

Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. A person can file Form 8300 electronically using the Financial Crimes Enforcement Networks BSA E-Filing System. New Form 1099-K Qualifications for the 2022 Tax Year.

Do large cash transactions get reported to the IRS. Beginning January 1 2022 accounts with 600 or more in gross sales from goods or services in the 2022 tax year will qualify for a Form 1099-K and must be reported to the IRS by Square. Beginning January 1 2022 the new federal threshold for P2P reporting is 600 down from 20000.

Cash sales would b. Tax Reporting with Cash For Business. If you receive a suspicious social media message email text or phone call regarding the Cash App or see a phone number that you.

Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for. Can you report on cash App.

1250 PM EDT October 16 2021. Do I qualify for a Form 1099-B. For nearly 20 years PayPal has been the preferred payment option for buyers and sellers who wish to enact their business over the internet.

People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. New cash app reporting rules only apply to transactions that are for goods or services.

Any errors in information will hinder the direct deposit process. Also if you make several deposits. For most states Square will issue a 1099-K and report to the IRS when you meet BOTH of the following thresholds.

If you have sold Bitcoin during the reporting tax year Cash App will provide you with a 1099-B form by February 15th of the following year of your Bitcoin sale. Apps like Square Paypal or other mobile payment services make it easy for you to accept card payments and keep a record of that income. PayPal Venmo and Cash App to report commercial transactions over 600 to IRS.

Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report. All financial processors are required to report credit card sales volume and then issue a 1099K I think its a K for that amount so that gets automatically reported to the IRS. This new 600 reporting requirement does not apply to personal Cash App accounts.

I believe they would have to get a warrant or supena or court order of some sort. Tax law requires that they provide users who process over 20000 and 200 payments with a 1099K before January 31st 2012.

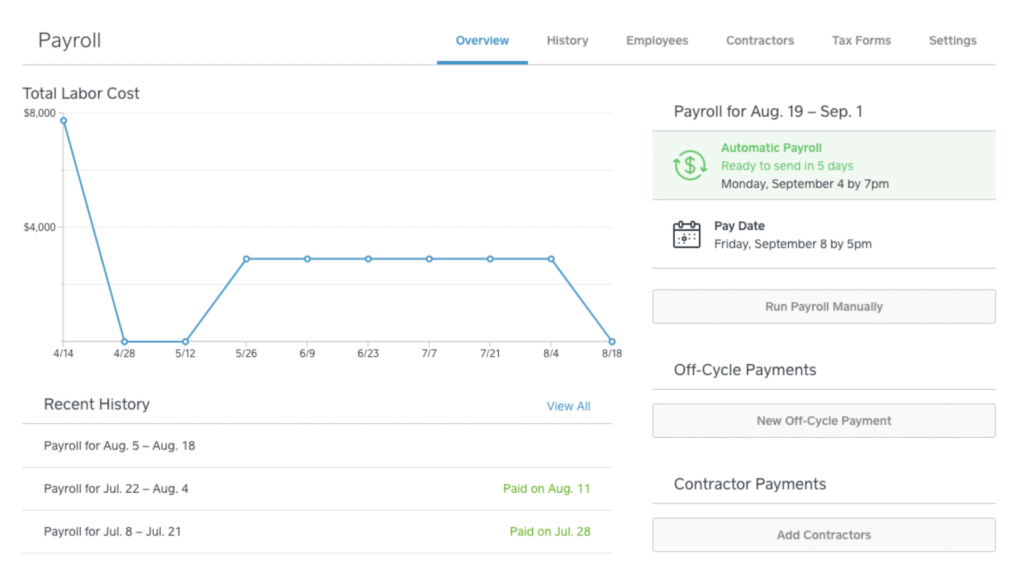

Square Payroll Tax Filings And Payments Square Support Center Us

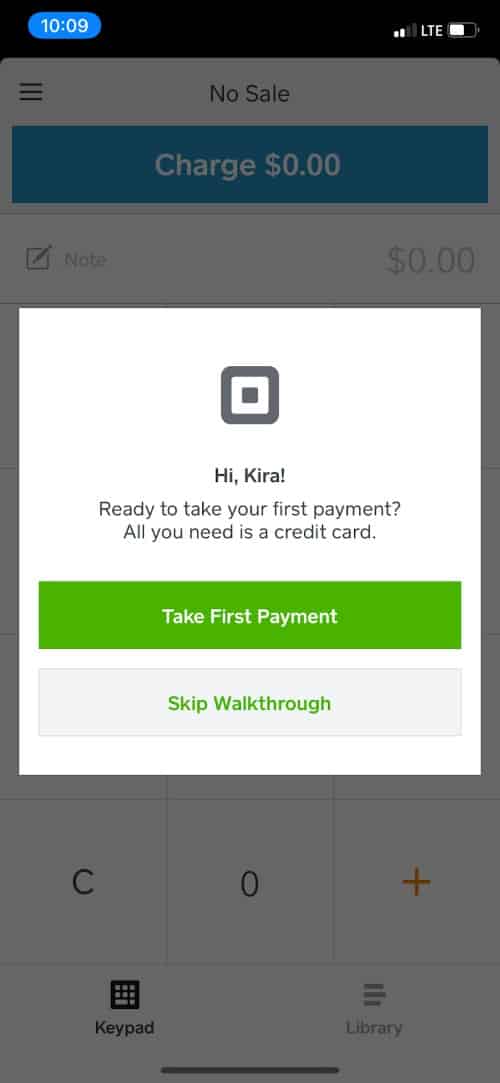

Square S Cash App Now Supports Direct Deposits For Your Paycheck Techcrunch

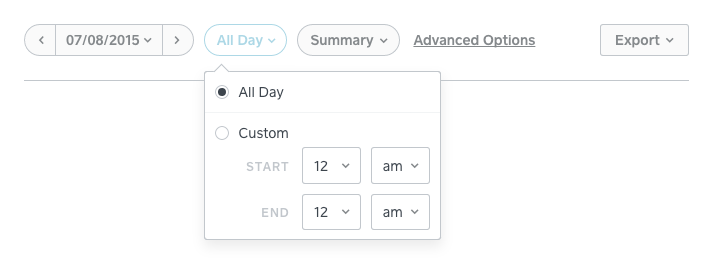

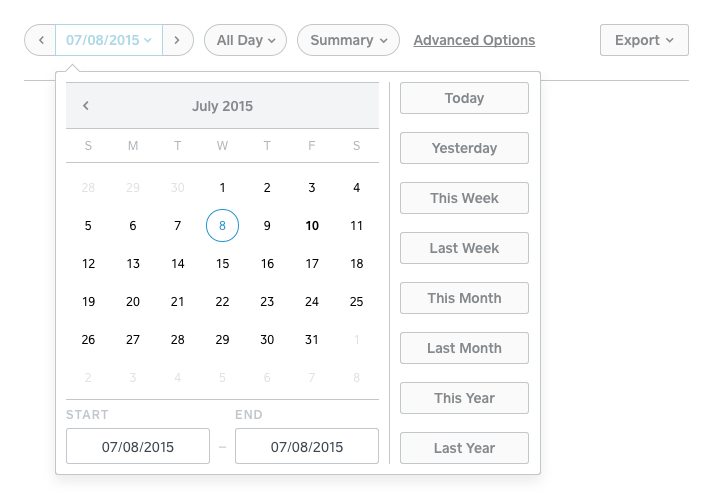

Summaries And Reports From The Online Square Dashboard Square Support Center Us

Square S Cash App Launches Apparel Collection Pymnts Com

Square Is Now Four Businesses Seller Cash App Tidal And Tbd Protocol

Summaries And Reports From The Online Square Dashboard Square Support Center Us

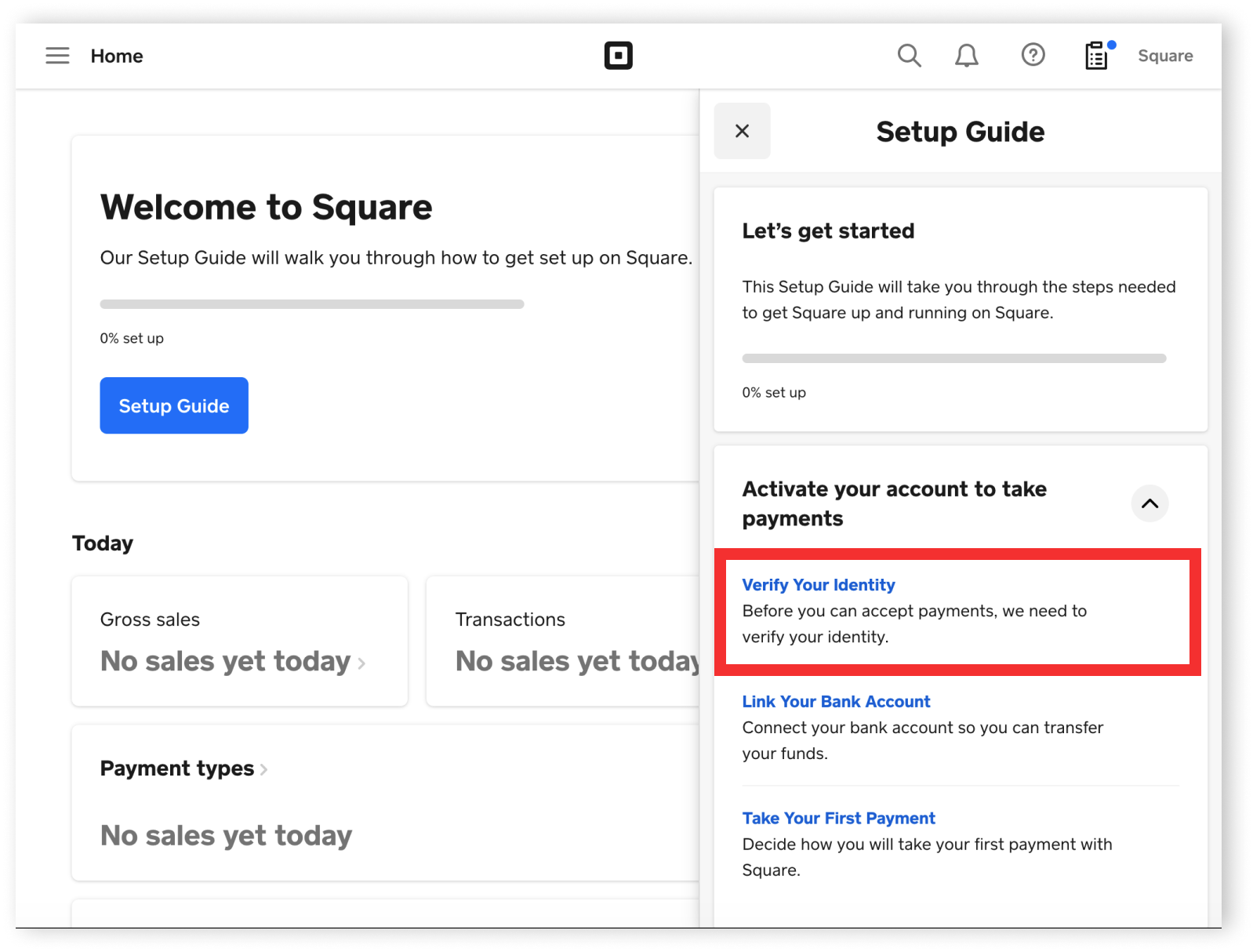

Required Documentation For Sign Up Square Support Centre Ie

Government To Tax Cash App Transactions Over 600 Youtube

Square Payroll Review Pricing Features

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Falcon Expenses Expense Report Template Expense Tracker Mileage Tracker App Tracking Mileage

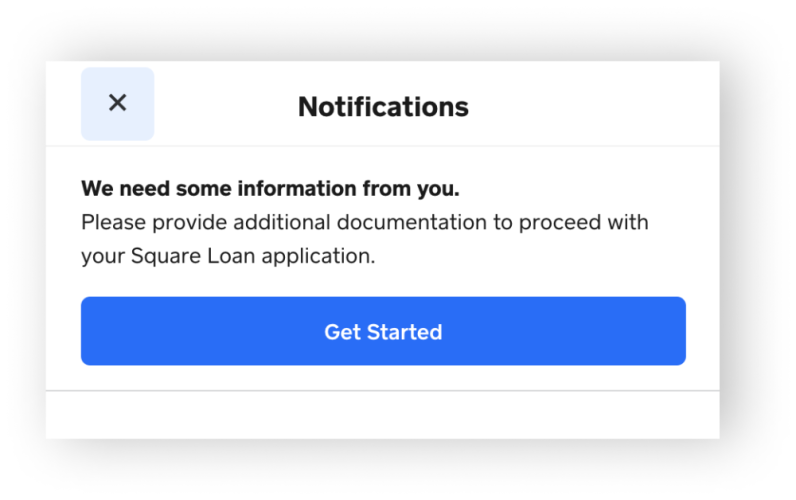

Information Requested For Square Loan Application Faq Square Support Center Us

Form 1099 K Tax Reporting Information Square Support Center Us

The Ultimate Square Pos Setup Guide

Square Review Fees Complaints Lawsuits Comparisons